However, despite that reality, all items might have a material influence on the company’s financials and must be disclosed. Designers mix these metrics to grasp the performance of their progressive disclosure strategy. In addition to progressive disclosure, designers make use of related methods to disclose https://www.kelleysbookkeeping.com/ info progressively. Progressive disclosure helps basic and superior customers find what they want faster. When designers simplify the primary interface, new users do not need to take a look at or learn via content material they don’t yet want.

Everything You Should Grasp Financial Modeling

- Thus, when given a choice between a quantity of outcomes the place the probabilities of occurrence are equally probably, you want to acknowledge that transaction resulting in the lower quantity of revenue, or no much less than the deferral of a profit.

- Gupta & Sons are concerned in a legal dispute that may result in significant financial obligations if the ruling goes in opposition to them.

- They are a consequence of usage and as such even prototyping may not lead you to the answers that you just seek when it comes to these ideas.

- Full disclosure is more than a regulation; it is a factor of monetary ethics and global belief.

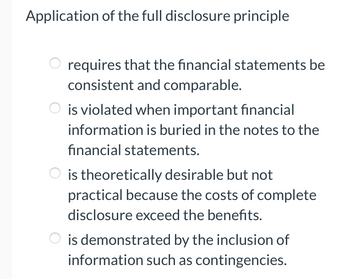

Businesses have to disclose any info essential for people who are anticipated to learn monetary statements to understand a business’s monetary position. As the total disclosure precept is known, corporations are technically required to share all of their monetary information including statements and any material that would assist someone higher understand that info. This leaves a bit up to interpretation as a outcome of, technically, this might cover a massive amount of fabric that’s most likely undesirable by the reader. Nonetheless, firms may also select to make voluntary disclosures to provide further insights to stakeholders. Voluntary disclosures can embrace information about future plans, sustainability efforts, or corporate social responsibility initiatives. The Total Disclosure Principle mandates that all relevant financial information have to be disclosed in monetary statements, making certain transparency for stakeholders.

Forms Of Disclosures

Moreover, it is possible to get info clarified using conference calls with third-party analysts or through other disclosure principle disclosures that are made. The most well-known instance of a company that went in opposition to the full disclosure precept was Enron. It is said that the corporate withheld lots of key data from their investors and fabricated some parts of their financial statements. If the buyers had identified about this beforehand, they’d haven’t invested within the firm in the first place. Corporations should disclose the accounting policies they follow and any adjustments to those policies. Explore how the Full Disclosure Principle shapes modern accounting, impacts financial statements, and adapts to latest regulatory modifications.

This can embody transactions which have already occurred in addition to future occasions contingent on third events. Any sort of information that would sway the judgment of an outsider should be included in the monetary statements in an effort to be transparent. The full disclosure precept of accounting is expounded to the materiality idea of accounting and talks in regards to the data disclosure requirements for the users of the financial statements of an entity. Such info is made obtainable to stockholders and different users either on the face of economic statements or within the notes to the monetary statements.

The objective of full disclosure is to offer users of financial statements with an entire and accurate understanding of an entity’s financial performance and place. Such data, be it supplementary or data displayed within the monetary statements, all are equally important. It not only indicates the current monetary position but also reveals any ongoing legal proceedings, potential liabilities or the varied methods and rules being adopted by the business. The materiality principle states that an accounting standard could be ignored if the net influence of doing so has such a small impact on the financial statements that a reader of the financial statements would not be misled. Underneath generally accepted accounting rules (GAAP), you wouldn’t have to implement the provisions of an accounting commonplace if an merchandise is immaterial. This definition does not provide definitive guidance in distinguishing materials info from immaterial info, so it’s essential to train judgment in deciding if a transaction is material.

Understanding Adequate Disclosure

Apple Inc. is thought for its detailed disclosures about product sales, revenue by geographical section, and details about its supply chain. By providing this data, Apple offers stakeholders a comprehensive view of its monetary health and operational efficiency. This apply has helped Apple preserve a powerful status and high levels of investor confidence.

Companies use the total disclosure principle as a guide to understand what monetary and non-financial data ought to be included in their financial statements. The full disclosure principle states that disclosed info ought to make a distinction as nicely as be understandable to the monetary statement users. The full disclosure principle states that information that might “make a difference” to monetary assertion users or can be useful in decision-making should be disclosed within the financial statements. This means traders or creditors can see a complete image of the company before they choose to take any action. Enron’s failure to completely disclose its monetary state of affairs led to one of the largest bankruptcies in U.S. historical past.

Quarterly Reports Via A 10-q

That is what monetary statements that follow the Full Disclosure Precept ought to ensure; no stakeholder is partial or privileged to receiving info. Every user gets the identical package deal of complete facts, making choices justly and leveling the enjoying area for info. The Total Disclosure Principle requires corporations to report their financial statements and disclose all material info.

For example, the corporate is dealing with a lawsuit resulting from disposing of poison material into the water, and it will be a big penalty. Thus, the above are some noteworthy advantages and drawbacks of the idea. It is necessary to know them in order that the knowledge may be applied properly for monetary determination making. Upgrading to a paid membership gives you access to our intensive collection of plug-and-play Templates designed to energy your performance—as well as CFI’s full course catalog and accredited Certification Applications. CFI is the global institution behind the monetary modeling and valuation analyst FMVA® Designation.